Key Player Allocates Additional $100 Billion Investment to U.S. Semiconductor Manufacturing Industry

For the last five decades, the global geopolitics have been shaped by access to energy resources such as oil and gas, as foundation for national wealth and power. (1) In the coming decades, the access to advanced semiconductor technology is going to determine the world order and supremacy. The narrative is that the leading country in artificial intelligence will also dominated technological progress, securing a position of strategic global hegemony. (2) These challenges in global power dynamics have prompted U.S. government to restrict the export of critical chips with the Framework for Artificial Intelligence Diffusion. (3) On 13th January 2025, U.S. expanded the controls on advanced computing integrated circuits, commonly referred to as microchips. The new regulations specifically target digital processing units with a „total processing performance“ (TPP) of 4800 or more, or those with a TPP of 1600 or higher combined with a „performance density“ of 5.92 or greater. As microchips become the most critical resource of this era, the Island of Taiwan, the world’s largest producer of microchips, has become the center of geopolitical tension between United States and China. Due to the intensifying geopolitical tensions, the risk of supply chain disruption has increased. Therefore, the U.S. intended in the recent years to reduce reliance on oversea manufacturing and strengthen its domestic production capabilities of advanced microchips.

TSMC: The key supplier for advanced chips

The need for enormous capital investments for specialized processing equipment and facilities for the advanced node chips developed within the last decade, prompted the outsourcing of manufacturing of advanced chips to foundries with the best processing technologies. While US semiconductor companies continue to lead in chip design, they have largely adopted a fabless business model fro advanced chips, maintaining only the fabrication of previous-generation semiconductors within the country. Taiwan Semiconductor Manufacturing Company (TSMC) with its pure foundry business model focused on offering the best processing technology and most flexible to ramp up next generation node fabrication processes, established itself as the market leader producing 92% of the world’s most advanced chips. The company success benefited from several factors including its Foundry Business Model, which means that it contract-manufactures chips for other companies, but not designing any chips themselves. In addition, the Taiwanese government subsidies, lower labor costs and accumulated expertise in its specialized workforce helped TSMC to attain dominance in the advanced chip manufacturing segment.

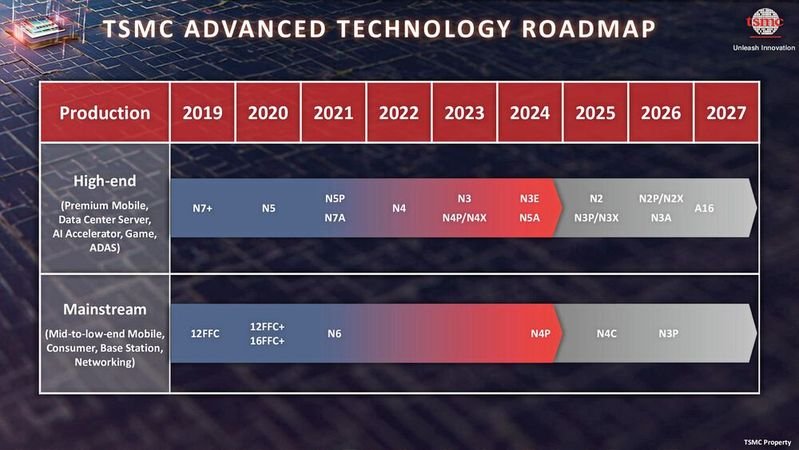

Image 1: TSMC Advanced Nodes Processes Technology Roadmap. Source: Presentation of TSMC Open Innovation Platform (OIP) Ecosystem Forum 2024.

Re-shoring manufacturing to the United States

As the U.S. intends to manufacture the advanced chips on domestic soil, TSMC announced in May 2020 a $12 Billion chip plant to be built in Arizona. Construction began in April 2021, and high-volume manufacturing with 4-nanometer (nm) node (N4) process, for Nvidia’s most advanced graphic processing units (GPU’s), commenced earlier this year. (4) In December 2022 the company revealed plans for a second fab in Phoenix, raising its total U.S. investment to $40 Billion. (5) This second fab is set to be operational in 2028, and plans to offer 2- (N2) or 3-nm-node (N3) processes. With $6.6 billion direct funding from the CHIPS and Science act, a third fab for advanced chips was announced in April 2024 increasing the invested capital to more than $65 billion. (6) On 4th of March this year, TSMC unveiled a historic $100 Billion investment in the U.S., the largest single foreign direct investment in U.S. history. (7) This budget will fund the construction of three new fabs, two new advanced packaging facilities and an R&D center. Apple is TSMC’s largest customer and accounts for 25.2% of annual revenue in 2023. (8) The significant percentage highlights Apple’s massive demand for high-end chips, and TSMC crucial role in Apple’s supply chain.

Image 2: TSMC annual revenue breakdown by customer in 2023. Replotted with data from (9).

Apple’s Unprecedented Investment in the United States

Hand-in-hand with TSMC investments goes Apple’s announcement at the end of February to invest $500 Billion in the U.S. over the next four years. (10) The investment package of Apple also includes a doubling of advanced manufacturing fund which commits multi-billion dollar fraction towards chipmaker TSMC. Apple's investment plan also encompasses the opening of an Apple manufacturing academy in Detroit to support the next generation of innovators, with focus on preparing student for a career in hardware engineering and silicon chip design. In addition, Apple builds a new manufacturing facility in Houston, Texas, to manufacture servers for its artificial intelligence platform „Apple Intelligence“. Along its projects, Apple plans to create around 20 000 new jobs.

Conclusion

The substantial investments from TSMC and Apple are strong financial impulses for domestic high-end chips manufacturing and hardware manufacturing for AI in the USA. Thereby, the USA has sped up the race to rebuild manufacturing of key components in the USA and reduces reliance on its ally Taiwan in the geopolitical tense situation with China. The money has spoken loudly, but whether these effort will be sufficient to secure long-term dominance in the AI and semiconductor sectors remains to be seen.